Less Stress, More Trust

А NEW MARKETING OPPORTUNITY

Enter CRM go to copy trade enter my accounts press in master account go to setting go to Promo Offers and create a offer for your client

Yes, he can determine the value of the minimum deposit for each subscription. The minimum balance that investors must have in their investment accounts to be able to subscribe to your main account. This is also the minimum balance that must be maintained in investment accounts after withdrawing funds to maintain subscriptions

No, there is no limit. One copy-trade account can be followed by thousands of followers.

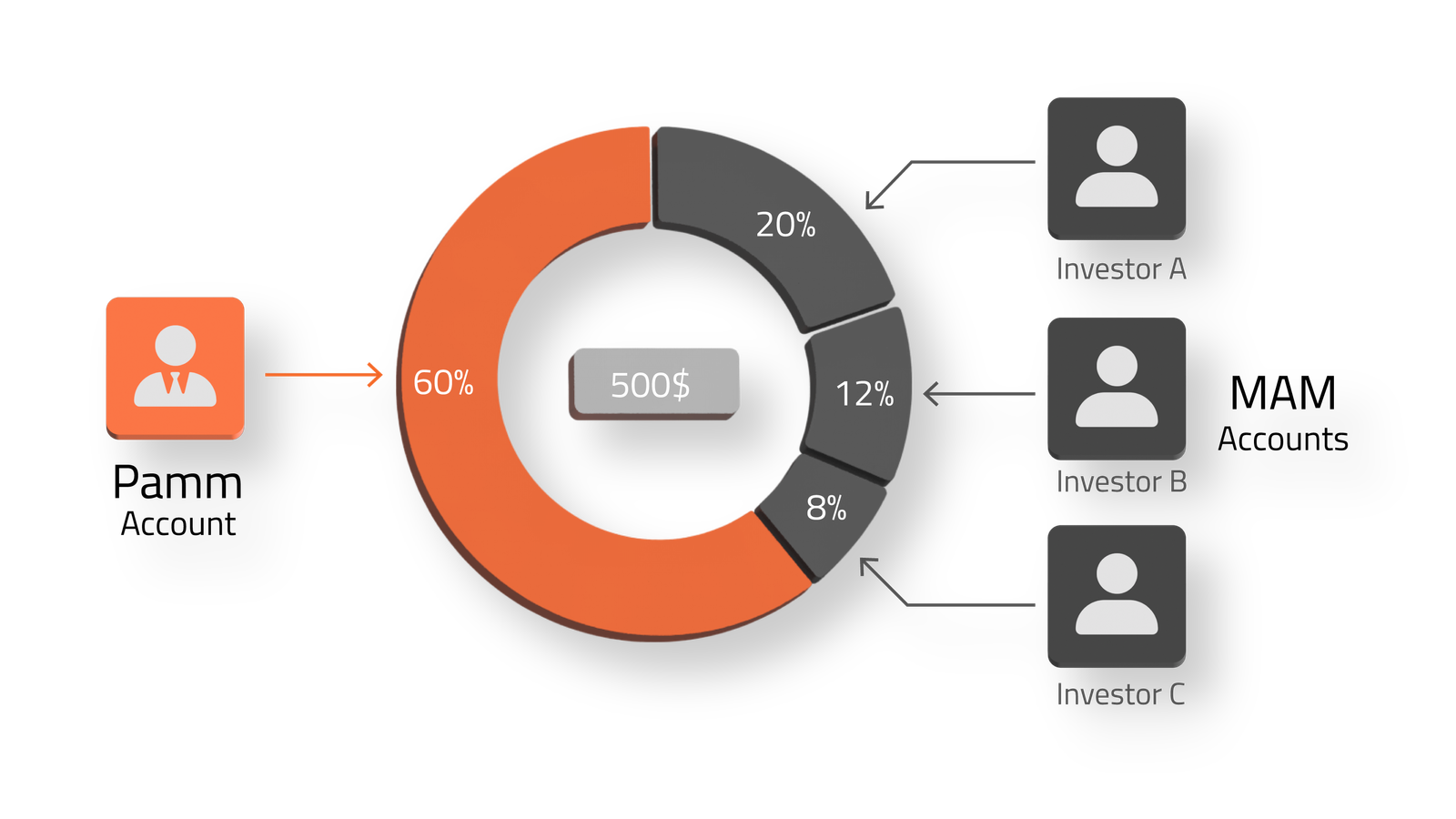

A PAMM account is a type of investment account where an investor allows a professional trader or manager to manage their funds on their behalf. The investor's funds are pooled together with other investors' funds, and the manager makes trades on behalf of the entire pool

No, all PAMM slave investment accounts are in read-only mode. Investors can only unsubscribe from a master but cannot trade on their own.

A PAMM account works by allowing a professional trader or manager to trade on behalf of a group of investors. The trader has access to the pooled funds and can make trades using a predetermined strategy. Any profits or losses are distributed among the investors based on their percentage of ownership in the account

Risk limit starts closing positions approximately 1 minute after reaching the signal level of equity. Please take care when making promises to your clients regarding speed of work and ensure you notify them that slippage is possible and that real losses can exceed any risk limit they set. Clients never should invest more than they are willing to lose.

The risks of a PAMM account include the potential for losses, as the manager's trading strategy may not be successful, and the lack of control over the trades made on your behalf. Additionally, there may be fees associated with investing in a PAMM account.

When selecting a PAMM money manager, you should look for someone with a proven track record of success, a trading strategy that aligns with your investment goals, and transparent communication about their trading activity and performance. It's also important to understand the fees associated with investing in a particular PAMM account.