How Does it Work:

A likely scenario is proposed for today, and the probability of achieving this scenario according to technical analysis may be between 60% and 75%, but if the first scenario fails, here the probability of achieving the second scenario becomes between 60% and 75%.

The preferred scenario fails when the price reaches the level of the alternative scenario condition, and immediately gets triggered and cancels the prediction in the preferred scenario.

These reports are not considered a substitute for the trader's decision, but rather an aid to the follower in making his own decisions, as a reference based on the origin of classic technical analysis.

Bullish Trend

First scenario: rise to 1.0831 if the 4h candle closes above 1.0792

Second scenario: if the price holds below 1.0800, the market might retest 1.0750 again

Bearish Trend

First scenario: bearish move towards 1.3245 if the 1h candle closes below 1.3300

Second scenario: rise towards 1.3400 zone if the 1h candle closes above 1.3340

Ranging Market

First scenario: rise towards 1967 if the price holds above 1955

Second scenario: if the 1h candle closes below 1938, this could trigger a fall towards 1935 – 1930 area

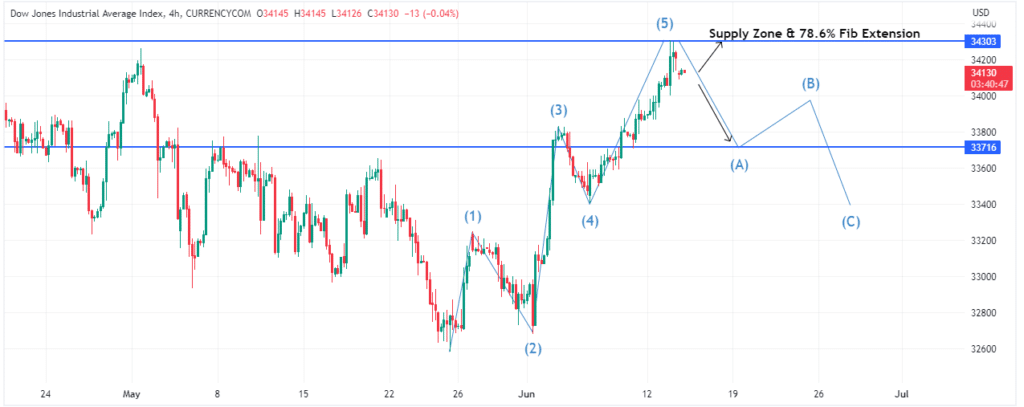

Bullish trend

First scenario: rise to 34400, if the 4h candle closes above 34160

Second scenario: if the price holds below 34050, this could trigger a fall towards 33870.

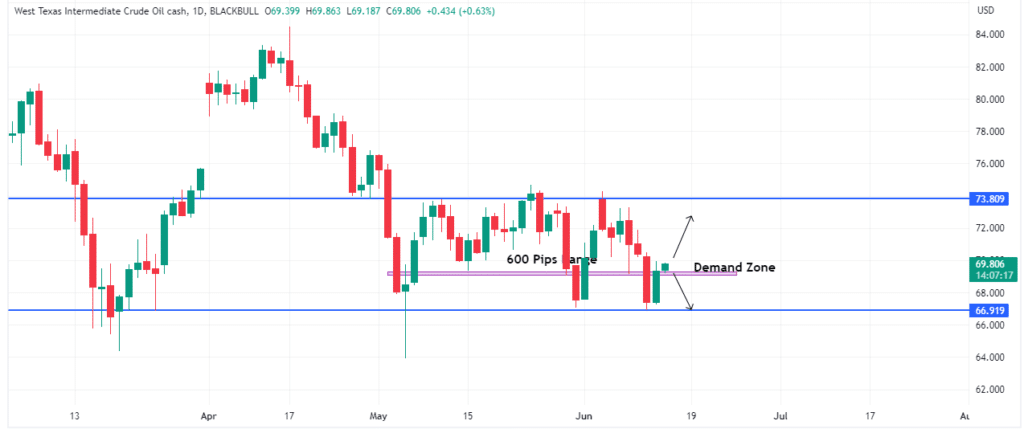

Ranging Market

First scenario: rise towards 72 if the 1h candle holds above 70

Second scenario: bearish move towards support 68 area if the 1h candle closes below 67

Notice :

The analyzes and opinions contained in this report are not binding and are not considered recommendations to sell or buy, and the company is not responsible for the decisions and choices of the investor, and the aim of this report is to publish general information through technical analysis.

Step 1 Register

Step 2 Fund

EURUSD1.2184 1.2186

GBPUSD1.4167 1.4169

USDJPY109.35 109.38

USDCAD1.2101 1.2103

Step 3 Trade