How Does it Work:

A likely scenario is proposed for today, and the probability of achieving this scenario according to technical analysis may be between 60% and 75%, but if the first scenario fails, here the probability of achieving the second scenario becomes between 60% and 75%.

The preferred scenario fails when the price reaches the level of the alternative scenario condition, and immediately gets triggered and cancels the prediction in the preferred scenario.

These reports are not considered a substitute for the trader's decision, but rather an aid to the follower in making his own decisions, as a reference based on the origin of classic technical analysis.

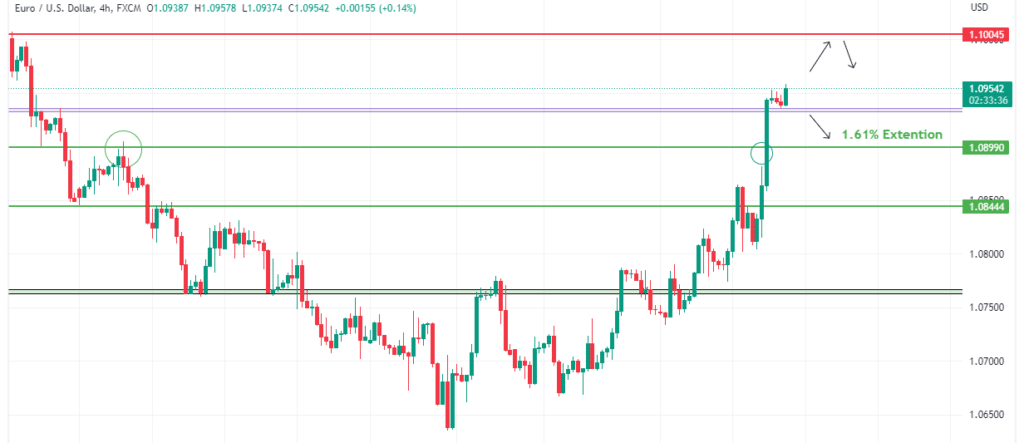

Bullish Trend

First scenario: rise to 1.10 zone if price hold above 1.095

Second scenario: if 4h candle close below 1.095 , this could trigger a fall towards 1.089

Bullish Trend

First scenario: rise to 1.29 area if 4h candle closes above 1.283

Second scenario: bearish move towards 1.271 zone if 4h candle closes below 1.282

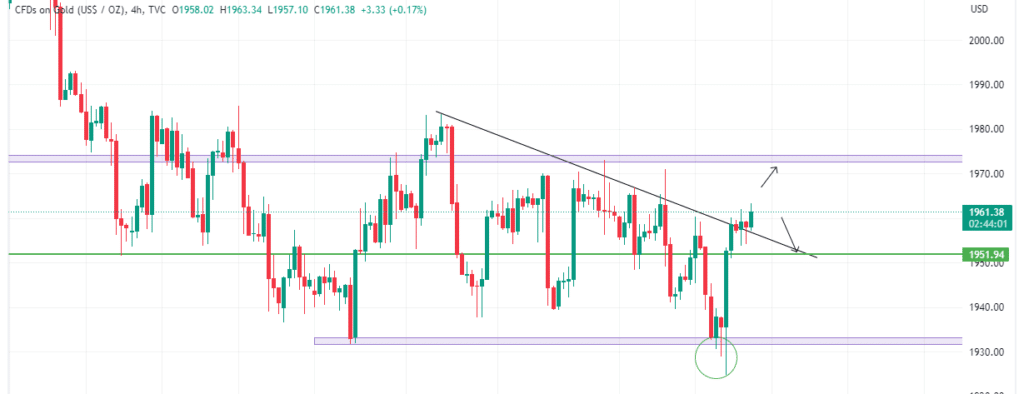

Ranging market

First scenario: rise towards 1973 if price hold above 1960

Second scenario: if 4h candle close below 1960 , this could trigger a fall towards 1950

bullish trend

First scenario: rise to 34590 if price hold above 34260

Second scenario: if 4h candle close below 34260, this could trigger a fall towards 33900 area

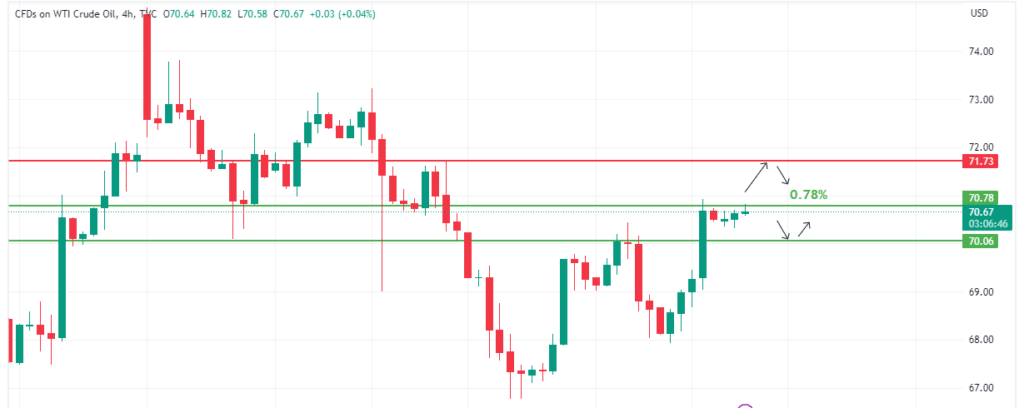

Bearish trend

First scenario: rise towards 71.73 if 4h candle close above 70,78

Second scenario: bearish move towards support 70.06 if 4h candle close below 70,78

Notice :

The analyzes and opinions contained in this report are not binding and are not considered recommendations to sell or buy, and the company is not responsible for the decisions and choices of the investor, and the aim of this report is to publish general information through technical analysis.

Step 1 Register

Step 2 Fund

EURUSD1.2184 1.2186

GBPUSD1.4167 1.4169

USDJPY109.35 109.38

USDCAD1.2101 1.2103

Step 3 Trade