Foreign exchange, or Forex for short, is a market where you’re able to exchange one currency for another. With a daily trade volume of $6.6 trillion dollars, the forex market itself is huge! It eclipses the likes of the New York Stock Exchange (NYSE) which, by comparison, has a trading volume of only $22.4 billion per day. As such, an OXShare client sells one currency against another at a current market rate.

The Forex Market’s sheer size attracts a wide range of different participants, including Central Banks, Investment Managers, Hedge Funds, Corporations, Brokers and Retail Traders – with 90% of those market participants being currency speculators!

It’s also important to note at this point that, while you are trading, millions of other traders are also entering the forex market.

So, when you 'sell' a currency, there is a buyer for that currency somewhere else. The more people that are trading, the more money there is in the market, which is what we call the 'liquidity'. As we’ve mentioned, the forex market is huge with millions of traders across the globe Because of this the liquidity in the forex market is really high!

In order to be able to trade, it is required to open an account and hold currency X and then exchange currency X for currency Z either for a long term or a short-term trade, with the ultimate goal varying accordingly.

Since FX trading is performed on currency pairs (i.e. the quotation of the relative value of one currency unit against another currency unit), in which the first currency is the so-called base currency, while the second currency is called the quote currency.

For example, the quotation EUR/USD 1.2345 is the price of the euro expressed in US dollars, which means that 1 euro equals 1.2345 US dollars.

Currency trading can be carried out 24 hours a day, from 22.00 GMT on Sunday until 22.00 GMT on Friday, with currencies traded among the major financial centers of London, New York, Tokyo , Frankfurt, Paris, Sydney, Singapore and Hong Kong ETC ..

Leverage is essentially the ability to place trades with the use of borrowed capital.

Leverage basically involves borrowing funds from your broker to enable you to control more funds when you’re trading. This is done through the use of a margin account and is partly responsible for the increase in forex trading popularity. It effectively allows retail traders to control a lot more money than they actually invest.

When combined with a solid risk management strategy, leverage in forex can lead to greater returns from FX trading, because it makes capitalizing on smaller price movements more lucrative.

But it can also lead to greater losses if you don't combine it with a well-thought-out risk management strategy.

Example

You’ve decided to trade with a leverage of 1:1000.

You’ve deposited $1,000 with your broker.

However, you’re actually able to control $1,000,000 for trading!

Margin in online forex trading is basically the amount of money that you need to open a position.

Forex brokers usually determine this as a percentage of the total position size, based on your chosen leverage.

To open a forex trade online with broker , you need to have enough funds in your account to meet the margin requirement for the trade.

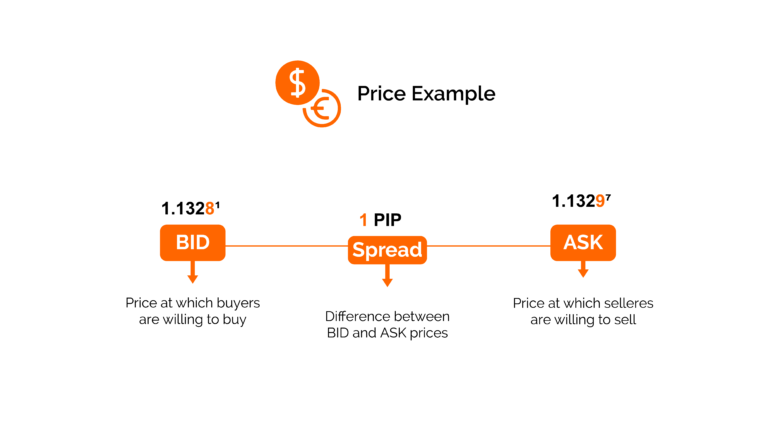

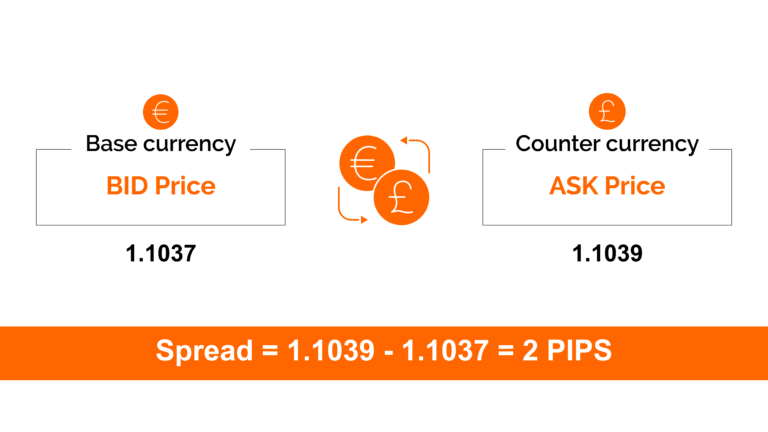

Spread effectively means the difference between two prices. It is the gap between the bid price and the ask price for your chosen currency.

The “Bid” is the price at which you sell the base currency, and the “Ask” is the price at which you buy the base currency! Now, the spread is the cost you incur to place a trade and can be affected by a variety of factors, the most important of which is the broker you are trading with.

It is important to note that a good broker will have a lower spread to ensure that you are not excluded from trading. Although these spreads tend to widen during times of high market volatility, a broker like OXShare will always offer you the lowest spreads available so you can trade efficiently and affordably.

Pips in Forex: Values & Pip Calculator

A “pip” stands for “price in percentage” or “price interest point” and is the smallest value of change within a currency pair when forex trading. Many currency pairs are priced to four decimal points,

example would be GBP/USD moving from 1.4000 to 1.4001. Here the price has moved by one “pip”.

Bid and Ask Definition, How Prices Are Determined, & Example :

What Is the Difference Between a Bid Price and an Ask Price? Bid prices refer to the highest price that traders are willing to pay for a security. The ask price, on the other hand, refers to the lowest price that the owners of that security are willing to sell it for.

Now, when we buy and sell a currency pair, you’re actually simultaneously buying one currency while selling the other. So, the ‘Bid’ price is actually the price where you sell a currency pair. So, it’s the price of buying the base currency against the counter currency!

In forex trading, some currency pairs are nicknamed majors (major pairs). This category includes the most traded currency pairs and they always include the USD on one side.

Major pairs include: EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, AUD/USD, NZD/USD These currency trading pairs are all available to trade completely swap-free at OXShare, so you can hold your positions for longer at no extra charge.

In forex trading, minor currency pairs or crosses are all currency pairs that do not include the USD on one side. These include AUDCAD, CADCHF, EURAUD, GBPCHF, and more. Most FX minors are also available with no charges at OXShare

Forex trading summary for beginners

Learn the basics (currency pairs)

Learn Software (MT4, MT5, OXShare)

Learn with demo accounts.

Look for a reliable service provider like OXShare.

Use service provider resources such as tools and guides.

Read books about trading and watch videos online.

Learn different trading strategies (fundamental analysis and technical analysis).

Participating in the Forex trading market through a broker such as OXShare means that the client gets access to more than 100 currency pairs worldwide and to real-time pricing of the Forex market. Buy and sell prices for a number of instruments are determined via the MT5 online trading platform or platform. oxshare. The customer is free to determine the price at which he decides to buy or sell, and he can execute the deal at any time he wishes. He can also withdraw his profits at any time he wishes.

Forex trading software is an online trading platform provided to each OXShare client, allowing them to view, analyze and trade currencies, metals, stocks, etc. Each OXShare client is given access to an online trading platform that is directly linked to global market prices and allows them to conduct transactions. Buying and selling without the help of a third party.

Step 1 Register

Step 2 Fund

EURUSD1.2184 1.2186

GBPUSD1.4167 1.4169

USDJPY109.35 109.38

USDCAD1.2101 1.2103

Step 3 Trade